Construction Equipment Industry and New Environmental Norms

The road to electrification of construction equipment is going to be far from easy. But the journey has already begun.

A total of around 3,200 exhibitors from 60 countries participated at bauma 2022 in Munich. Photo credit: Final Report, bauma 2022

Construction is one of the largest industries globally with a huge impact on the economies of nations. From housing to commercial buildings and industrial estates to developmental projects, it is the construction industry that plays a vital role in creation of the basic infrastructure for all human activity. According to a recent report by The Business Research Company, the global construction industry reached a value of nearly $13,570.90 billion in 2021, having increased at a compound annual growth rate (CAGR) of 4.6% since 2016. From here, the market is expected to grow to $22,873.96 billion in 2026 at a rate of 9.8%, and then grow further at a CAGR of 11.5% from 2026 and reach $39,352.08 billion in 2031. If these figures sound astounding, the reality is, a sizable chunk of the population – 16% in the case of a country like India – is also engaged in the sector, directly or indirectly.

Within the construction industry, equipment – mobile and stationary – plays a major role, one facilitated by technology, in sustaining the pace of the industry. As per the study of another research firm, Fortune Business Insights, the global construction equipment market is projected to grow from $141.99 billion in 2021 to $222.14 billion in 2028 at a CAGR of 6.6% during the forecast period. Among the leading players in the global construction equipment market are names such as AB Volvo (Sweden); Caterpillar Inc (US); Komatsu Ltd (Japan); Doosan Infracore Co Ltd (South Korea); Hitachi Construction Machinery Co Ltd (Japan); J C Bamford Excavators Ltd (UK); Liebherr Group (Switzerland); CNH Industrial NV (UK); Hyundai Construction Equipment Co Ltd (South Korea); and the SANY Group (China).

Construction equipment, also known as Non-Road Mobile Machinery (NRMM), is a broad term that covers a wide range of equipment used in construction projects, which can be classified as:

i. Construction Vehicles – Trailers, Dumpers, Tippers, etc.,

ii. Equipment for Earth Moving – Excavators, Loaders and Bulldozers

iii. Equipment for Material Handling – Cranes, Telehandlers and Forklifts, and

iv. Equipment for Handling other Construction Materials – Concrete Mixers, Road Rollers, etc.

Besides, there are other machines and equipment like piling rigs, mobile cranes, static pumps, etc. These are all heavy-duty vehicles specially designed for specific applications, and are also known as heavy machines, heavy trucks, construction equipment, engineering equipment, heavy vehicles, or heavy hydraulics. Though these are mobile equipment, they are not intended for carrying passengers or goods on the road and are powered by conventional combustion engines. There are also generators and compressors used at construction sites, equipment that are not self propelled.

The Cat® 350 hydraulic excavator known for excellent reliability and durability. Photo credit: Caterpillar

Emissions from construction equipment

The construction industry as a whole causes a lot of pollution including air, water, soil and noise pollution, depending on the nature of construction. It is one of the main producers of greenhouse gasses (GHG) and is now the subject of increased attention from regulatory agencies. If the site is the place where existing structures are first demolished, then the pollution is much higher. For example, activities like excavation and piling cause a lot of dust pollution. According to a research study conducted a few years ago, the construction sector contributes up to 23% of air pollution, 50% of the climatic change, 40% of drinking water pollution, and 50% of landfill wastes. However, the subject of this article is the emissions of construction equipment and how these are sought to be regulated by the new and emerging environmental norms.

Most of the construction equipment runs on diesel engines. In theory, since diesel fuel is a mixture of hydrocarbons, during an ideal combustion process, it would produce only carbon dioxide (CO2) and water vapor (H2O), besides the unused charged air which also contains oxygen. The resultant volumetric concentrations are typically CO2 – 2 ... 12%; H2O – 2 ... 12%; O2 – 3 ... 17%; and the balance, N2. In reality however, the combustion process is far from ideal as the volumetric concentrations depend upon the engine load, with the content of CO2 and H2O increasing and that of O2 decreasing with increasing engine load. The diesel lobby maintains that none of these principal diesel emissions, with the exception of CO2 for its greenhouse gas properties, have adverse health or environmental effects. But in practice, the diesel emissions also contain pollutants and particulate matter that have possible harmful effects on both health and environment. Construction machinery also emits a large amount of carbon monoxide (CO) and sulphur dioxide (SO2) into the air, gases that are harmful to human health. Such pollutants are the result of improper combustion process resulting from a host of factors like ageing and worn out engines, long running hours, improper maintenance and servicing, diesel contaminated with engine oil as well as additives and high sulphur content in the fuel.

The emissions from construction equipment are invariably much worse than regular road vehicles as they often do not have emission control systems like catalytic converters, nor are they regulated as stringent as other categories of vehicles. As for regulations, countries across the world are now either imposing, or are in the process of framing, stricter environmental norms in the wake of sustained pressure mounted by the larger net zero debate.

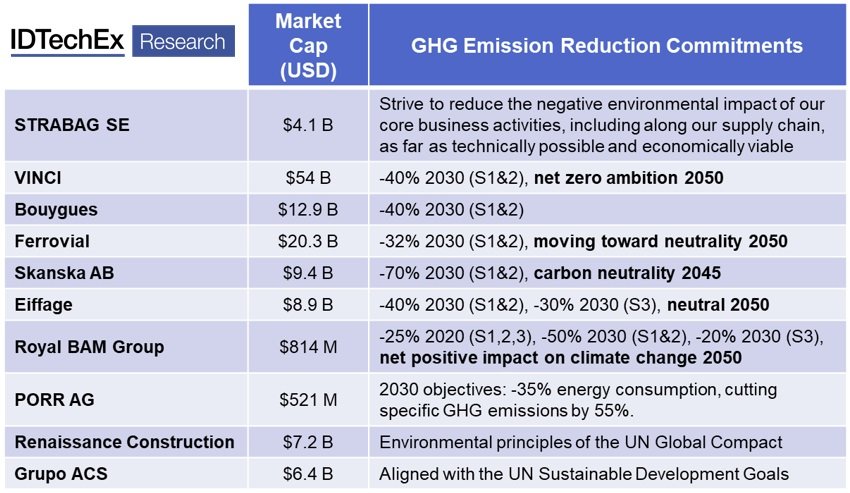

The Emission reduction targets of leading European construction firms. Source: IDTechEx – “Electric Vehicles in Construction 2022-2042”

In the UK, for example, stricter emissions regulations have come into place for non-road mobile machinery (NRMM). The London Atmospheric Emissions Inventory 2019 (published in December 2021) estimates that NRMM exhaust emissions in construction are responsible for approximately 70 tons of Particulate Matter (PM) and 1350 tons of toxic Oxides of Nitrogen (NOx) emissions in London each year. The NRMM Low Emission Zone uses the Mayor and London Borough’s planning powers to control emissions from NRMM used on construction sites. The current standards are Stage IV for construction machinery operating in the Central Activities Zone and Opportunity Areas (including Canary Wharf) and Stage IIIB in the rest of London. The standards for the NRMM Low Emission Zone will get progressively tighter over time:

- From 1st January 2025 the standards will be stage IV throughout London

- From 1st of January 2030 the standards will be stage V throughout London, and

- From 1st of January 2040 only zero emission machinery will be allowed.

In the European Union, the NRMM Regulation defines emission limits for NRMM engines for different power ranges and applications. It also lays down the procedures engine manufacturers have to follow in order to obtain type-approval of their engines – which is a prerequisite for placing their engines on the EU market.

The impact of the new NRMM Regulation is good for business and good for the environment with the following outcomes:

- Protects health of EU citizens

- Protects the environment and improves air quality in the EU

- Ensures the good functioning of the internal market for NRMM engines, avoiding market distortions and market fragmentation in the EU – ensures a level playing field on global markets, and

- Avoids unfair competition from non-compliant low-cost products.

HAMM’s first fully electric battery-driven tandem rollers of HD CompactLine series. Photo credit: Wirtgen Group

Some European cities have already taken the lead to pilot the world’s first zero-emissions construction sites. Oslo, the capital city of Norway, is promoting green construction. In 2019 they established the first zero-emission urban construction site, and from 2030 onward, they will, along with six other major cities in Norway, ban non-zero emission machines from construction sites. Similar is the case with Copenhagen – Denmark, Helsinki – Finland and Stockholm – Sweden.

Similarly, in the US, the Environmental Protection Agency (EPA) has adopted multiple tiers of emission standards. The agency has progressively pushed for more stringent emission standards for carbon monoxide, hydrocarbons, nitrogen oxides, and particulate matter, starting in the mid-1970s for on-road vehicles and in the early 1990s for non-road engines and equipment. More recently, EPA has adopted a comprehensive national program to reduce emissions from non-road diesel engines by integrating engine and fuel controls as a system to gain the greatest emission reductions. To meet these Tier 4 emission standards, engine manufacturers will produce new engines with advanced emission control technologies. Because the emission control devices can be damaged by sulphur, the EPA has also adopted requirements for in-use diesel fuel to decrease sulphur levels by more than 99 percent. The resulting Ultra Low Sulphur Diesel Fuel has a maximum sulphur concentration of 15 parts per million. To that end, manufacturers must ensure that each new engine, vehicle, or equipment meets the latest emission standards. Once manufacturers sell a certified product, no further effort is required to complete certification. If products were built before EPA emission standards started to apply, they are generally not affected by the standards or other regulatory requirements. However, the EPA does not require owners to retire their old engines, vehicles, or equipment.

In India, Emission Norms for diesel driven Construction Equipment Vehicles (CEVs) were introduced in 2000 and further revised in 2007. In March 2018, the Ministry of Road Transport and Highways released the final rule for non-road Bharat Stage (CEV/Trem) IV and V emission standards, including stringent emission limits on particulate matter (PM), particulate number (PN) (BS V only), nitrogen oxide (NOx), hydrocarbon (HC), and carbon monoxide (CO). This is the first time India has adopted one set of consistent standards regulating both agricultural and construction equipment. Stage IV CEV emissions standards are in force from 1 April 2021 for construction equipment vehicles and Stage IV TREM standards were due from 1st October 2022 for agricultural machinery. Stage V standards, for both engine categories, are due to be implemented from 1 April 2024. The BS (CEV/Trem) IV and V standards are in general alignment with the European Stage IV and V standards for diesel engines used in non-road mobile machinery. India has now become the first region outside of the European Union to adopt Stage V-equivalent emission standards, moving ahead of countries such as the United States, Japan and China in its control of emissions from new diesel powered non-road equipment.

The Bobcat all-electric compact track loader, the T7X. Photo credit: Bobcat

Electrification of construction equipment

Given the tightening environmental norms – stringent emissions and noise regulations – for construction equipment, major manufacturers in the sector are now investing heavily to electrify their equipment. According to a recent report by Research and Markets, the electric off-highway equipment market is estimated to grow from USD 9.2 billion in 2022 to USD 24.8 billion by 2027 at a CAGR of 22.0% over the forecast period. The report mentions that all key countries have established programs/regulations to deal with GHG emissions in the transportation industry. Most countries follow Euro equivalent Standards, such as Stage IV or V. The PM limit of the Stage V standard is 97% lower than that of the Stage I Standard, and the hydrocarbon (HC) + Nitrogen Oxides (NOx) limit is 94% lower. Apart from the emissions and noise regulations, high ventilation costs are also driving the demand for electrification for equipment used in the mining industry.

The latest report by IDTechEx, ‘Electric Vehicles in Construction 2022-2042’, firmly states why the construction industry emission targets demand electric machines. Though the carbon dioxide emissions from off-road construction vehicles account for only around 1.1% of global emissions, the International Energy Agency estimates that the construction industry is responsible for approximately 20% of global emissions when the production of building materials (cement, steel, glass, etc.), and infrastructure construction projects are included. The IDTechEx is all about the finer details of off-road zero emission construction machinery and explores the electrification efforts of key players in the segment, highlighting technical and economic considerations of powertrain electrification over the diverse range of mobile construction machines, including excavators, loaders, cranes, and telehandlers. The report details a long-term 20-year outlook for the sector, with IDTechEx's independent sales, battery demand and market revenue forecasts for electric construction vehicles out to 2042 and broken down by region (China, US, Europe, RoW).

At the recent bauma – the world's leading Trade Fair for construction machinery, building material machines, mining machines, construction vehicles and construction equipment – held from October 24 to 30 at Munich, zero-emission operation was one of the major trends in the construction machinery industry. For example, Wacker Neuson, a global supplier of a broad portfolio of construction machines and equipment, spare parts and services, showcased some all zero emission innovations. Leading the pack was the first battery-powered reversible vibratory plate with direct drive on the market, APU3050e. The DireX direct drive developed by Wacker Neuson ensures greater efficiency. Other innovations included the electric RD28e roller powered by a tried-and-tested lithium-ion battery; the first electric telehandler, the TH412e with a lifting height at the hinge pin of 4.5 meters; the third generation of the WL20e E-wheel loader with a powerful lithium-ion battery; and a new charging box as a power bank for the construction site.

HAMM, a Wirtgen Group company, presented its first fully electric battery-driven tandem rollers. The models form part of the HD CompactLine series and will initially be available for the European market. HAMM displayed two models at bauma: The HD 12e VO, a tandem roller with one vibration drum and one oscillation drum, and the HD 12e OT, a combination roller with oscillation. The first electric models are scheduled for delivery in spring 2023 to those regions where the EU Stage V exhaust emission standard currently applies. Many of these countries provide government grants to assist with the purchase of fully electric construction machinery as well as the development of the necessary charging infrastructure.

The Volvo CE powers a sustainable future with the largest range of electric machines. Photo credit: Volvo CE

Bobcat showcased the world’s first all-electric compact track loader, the T7X, still in the concept phase, with the aim of assessing market opportunities for the machine in Europe, the Middle East and Africa. With its 62-kWh lithium-ion battery pack, the T7X can operate continuously for four hours. Its mobile payload is just below 1,400 kg. In contrast to all other loaders worldwide, the new machine requires virtually no fluids: Bobcat has completely replaced the traditional hydraulic system with an electric drive system comprising electric cylinders and electric drive motors. The only liquid in the machine is about four liters of environmentally friendly coolant. “The T7X compact track loader is a technological feat for Bobcat and the industry,” said Joel Honeyman, Vice President of Global Innovation, Doosan Bobcat, during his presentation at bauma 2022. “Operators who drive these machines are excited about the exceptional power, response time and performance that match or exceed the diesel machines they are accustomed to operating, but with no emissions and quiet operation.”

After bauma, in early November 2022, Bobcat introduced three battery-powered compact excavators: the E10e, E19e and E32e – delivering all the benefits of electric power and zero emissions without sacrificing performance. “With these low-maintenance, battery-powered excavators, Bobcat continues to bring leading innovations to the compact equipment industry and redefine how work gets done,” said Bobcat Product Specialist Justin Moe, while making the announcement. “Quiet and emissions free, the E10e, E19e and E32e can work when and where other excavators can’t, offering more solutions for today’s diverse job sites.”

The quest for electrification of construction equipment has been in the making for years. Hitachi Construction Machinery Co, for example, had highlighted its electric offerings at the MINExpo International 2021 event at Las Vegas, USA, with the electric version of its famed EX-7 Series of mining excavators that offers zero emissions with no compromises when it comes to performance. According to the company, the Hitachi EX5600-7E electric excavator optimises productivity in an environmentally conscious way. Like all Hitachi excavators, this machine is easy to operate with electronically controlled hydraulic pumps, an optimised cooling package and enhanced hydraulic circuits. Electric is powerful with no compromises, it says.

Volvo Construction Equipment (Volvo CE) too debuted three new electric compact machines – the L20 Electric, EC18 Electric and ECR18 Electric – in mid-2021, showcasing its commitment to build a zero emissions range of electric machines, providing customers with a cleaner, more silent and more comfortable work environment. In early 2022, the company launched its first 2.5-ton battery electric compact excavator in the Asian market in South Korea with further roll out plans for China, Japan and Singapore. The demand for electric equipment has been growing across the region, prompted by stronger emission regulations, government incentives and an urgent desire to build more sustainably. According to Jaetack Lim, Head of Market Korea at Volvo CE Region Asia, “Increasingly, authorities are recognizing the need to work more sustainably and embrace new technologies that will allow us to tackle our global climate change crisis with equipment that provides less noise, fewer vibrations and no exhaust fumes. We are proud to be leading the charge by being the first major manufacturer to offer electric solutions to a region that is so significant to the global construction equipment market.”

Summing up

The road to electrification of construction equipment is going to be far from easy. But the journey has already begun, with small steps. Hybrid drivetrains have been around for years, and so are examples of heavy equipment operating electrically with power drawn from overhead cables. High cost of batteries and charging infrastructure, initial resistance by operators, (battery) capacity constraints and above all, scepticism that comes naturally with any attempt to change the status quo and the obstacles on this path. On the other hand, environmental benefits in face of global efforts towards a net zero ecosystem, better health and working conditions for the operators, and growing clamour globally for stricter regulations to ensure noise- and pollution free construction sites are driving the change. Electric drive trains are also easy on maintenance, as they contain fewer moving parts. In the long run, the benefits of electrification of construction equipment far outweigh the initial disadvantages including high initial costs.